Money was coming in faster than I could count. Guys around me were envious.

Consistently stacking up cash made me feel like a boss. I remember thinking, “Is this how it feels to be rich?”

None of my best friends were having success yet. They hadn’t learned how to play the game, didn’t know winning was earned.

I was successful because I’d gone broke more than once. Through it all, I developed patience, persistence and resilience.

Finally, I was consistently winning.

It wasn’t my job to teach my buddies—nobody taught me. They’d need to learn the same way I did, through observation and failure.

My path to success was buying houses and earning rental income. Guys were consistently handing me wads of money for rent payments. I’d accept it without counting. I didn’t want to humiliate anyone—I knew how it felt to give nearly half my money away in rent.

Confident the plan would continue working, I kept rolling the dice and looking for more opportunities.

These boys would be indebted to me for a long time. The clock seems to move slower when you’re 8 years old. Monopoly can take hours.

Real-Life Monopoly

A youthful passion or predilection is sometimes all it takes to get a vision for what the future could be. Monopoly fascinated me as a kid. Anyone who landed on a property I owned had to pay me rent while I continued pursuing other interests.

I would later discover the board game is a microcosm for real-life real estate investing. Notwithstanding the notable exception of real estate investing not being a zero-sum game, there are countless parallels to the Monopoly board game:

- Both involve strategy more than chance

- Trade & negotiation skills are needed

- The right deals take time, patience & persistence

- You can increase the likelihood of success following a proven model

Start with a Vision

My vision for investing success starts with knowing the income from properties I buy & hold are going to support a family someday. Visualization of this future reality requires that I set goals and develop a strategy to make it happen. (Read more about my strategy in my very first blog article: real estate investing for financial independence.)

There are particular neighborhoods in the Houston area I’ve studied for 15 years. I know the neighborhood streets better than those I grew up on.

If and when a property becomes available in my targeted areas, I know right away. By setting myself up in the Multiple Listing Service to receive notifications, I’ve effectively outsourced much of the discipline and patience required. If a deal deviates even slightly from the parameters I’ve set, I do not chase. In fact, unaware of the property’s availability, I’m not even tempted to pursue.

Real Estate Tax Benefits

Our government encourages us to acquire property through low barriers to entry and tax incentives. Real estate ownership is protected because it promotes society’s ability to build financial wealth & prosperity. Consider the “3 D’s” of tax benefits offered:

Depreciable – claim depreciation on taxes for real estate assets’ normal “wear and tear”

Deductible – upkeep, maintenance, improvements and interest paid on investment properties are tax deductible

Deferrable – use IRAs & 1031 Exchanges to defer paying taxes. Profits from rental income and property sales that remain in an IRA are tax-deferred

Investors don’t get excited about tax refunds. A refund serves only as an indication you’ve overpaid taxes throughout the year. You’ve essentially allowed the government to borrow your money at 0% interest—money that could’ve been invested was instead sitting in government coffers.

The Importance of Networking

A solid network is a force multiplier that will help you do more with less effort. Networking starts when you develop yourself to become a person of value to someone else. Contrary to popular belief, networking doesn’t begin with developing contacts to further your own interests or career.

High caliber networks are attracted to you based on the person of value you’ve worked hard to become. Relationships take time to cultivate; there are no shortcuts. Don’t ask someone for a favor or ask to “pick their brain,” if you haven’t first provided value to them.

My favorite networking book is Dig Your Well Before You’re Thirsty by Harvey Mackay—title speaks for itself.

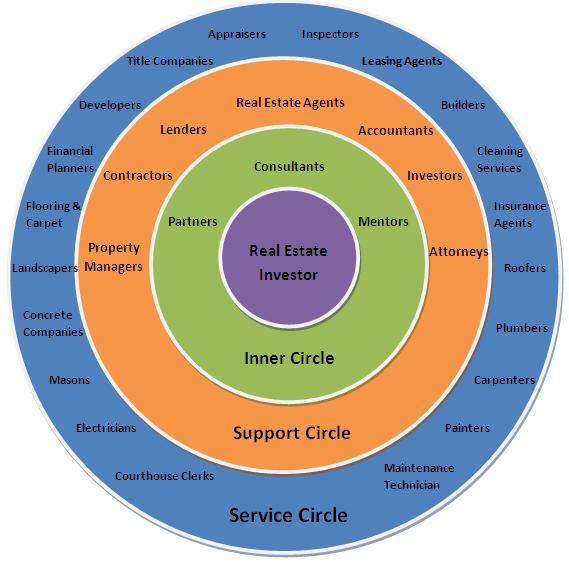

Real estate investing requires you to develop a network of contacts that will allow for mutually beneficial relationships. Your network will help you to find opportunities and mentor you, help close deals and provide services.

You Can Lead a Horse to Water

A friend asked a few months ago if I would help him acquire a single-family home that could be leased long-term. His goal was to create an additional income-stream for his family.

He went into great detail about his plan to use a rental house as a vehicle to pay for his kid’s college. Admirable indeed—he was inspired!

After giving him an overview of the buying process, I shared information on the neighborhoods I target. I told him when something comes available, I pounce, ala Jimmy Iovine in The Defiant Ones: “Go!”

Passing “Go” in real life is worth more than $200 à la Monopoly—we’re after much higher compounding returns.

I said to my friend, “If you want to pursue the next deal I come across, I’ll help you. But you’ve gotta be ready to take action.”

He said, “I’m in.”

Less than a month later, a deal hit my inbox and I forwarded it along. When I didn’t hear back, I texted him. Crickets.

Three days passed and I still hadn’t heard back. (Notice on the blackboard above that “inspiration” isn’t on there—inspiration without action is a non-starter.)

So I took action and bought the property myself.

Much of real estate investing success boils down to making the highest & best use of time and going after what you want (taking action). I won’t let a deal I’ve hand-chosen for my friends/clients go to someone else. The reason? My days start with a cup of coffee. I’ve seen Glengarry Glen Ross—I know who coffee is for.

Discipline Weighs an Ounce. Regret Weighs a Ton.

I ran into my hesitant friend at a dinner several weeks later. He apologized for not getting back to me; said he’d been “swamped at work” and “busy planning a vacation.”

I smiled and said, “Don’t apologize to me, brother, apologize to your family.”

The look on his face told me he didn’t get it—most don’t. Regret comes later. He asked that I send him more information.

“If information were the answer, we’d all be billionaires with perfect abs.” – Derek Sivers

Squander the day with short-term thinking and busywork at your peril. If you’re a grown ass man who hasn’t yet internalized that most famous of two-word Latin aphorisms—carpe diem—you maybe never will.

Do not spend more time planning your vacations than your future.

“We must be careful not to let our current appetites steal away any chance we might have for a future feast.” – Jim Rohn

Last week while most people were “busy” or planning vacations, I indulged the nostalgic feeling of being 8 years old again. Adding income streams makes me feel rich.

The coolest part about this last purchase: I now own two properties in the same neighborhood!