On the weekends when I was a kid, my parents would cozy up next to each other on the couch. There’d usually be a football or baseball game on TV. Then seemingly out of nowhere, they’d start play-wrestling.

My dad would say, “Aw, don’t give me that sh*t!” or “That’s your a$$, woman!”

Meanwhile, I was on the other sofa wishing I could make myself disappear. It was awkward to see grownups be flirtatious.

After a few minutes of banter, they’d scamper off.

I’d say, “Hey, where are y’all going?”

My dad would half-turn his head and say, “We’re just going in the bedroom—we’re gonna take a nap.”

I’d hear the door lock, and think who takes a nap full of energy?

The game could be tied in the ninth inning. They didn’t care.

If Memory Serves Me Correctly

Five or six years ago, the memory from those lazy afternoons hit me while getting ready for work. It was the first time I’d ever thought about it.

Why did I recall a seemingly non-event almost three decades later?

Who knows how that works. But when an innocuous memory pops in my head, I assume it wouldn’t arrive [in my head] unless it had something to teach me. And it did.

My parents unknowingly (to either of us) provided an example of a happy couple. They demonstrated how playfulness increases polarity, which might lead to more naps, which strengthens bonds, increases fulfillment, and engenders more happiness.

I began to ponder whether the “afternoon delight” could be the path to all good things listed above. If so, I would need to reorient my life to allow for naps.

Suddenly, I had new incentive to achieve FIRE (financial independence retire early).

Uniquely busy

After my initial thought Who takes a nap full of energy? I remember thinking Why do they only nap on weekends?

10 – 30 minute naps have been proven to help with mental alertness, energy and productivity. Whereas any more than 30 minutes and you’ll wake up sluggish. But unless you’re willing to move to Spain, you have Powerball-odds of your boss approving a siesta.

If by now you’re wondering Who has time for a nap anyway? Well, I do. But only because I worked my face off for many years. In fact, I didn’t let off the accelerator until I had generated enough passive income to retire in my thirties.

I’m not boasting about my work ethic, please don’t take it that way. In fact, I don’t even like the guy who humble-brags about how busy he is. It’s weird coming from an American.

Maybe I’ve just seen too many men and women in third-world countries toiling in the sun from dawn-to-dusk to feed their families, to be impressed by “Johnny ‘I’m Crazy Busy.'”

A few examples. In Indonesia, they don’t talk about how busy they are. People don’t call themselves “go-getters” in Vietnam. Come to think of it, actual go-getters in America aren’t the ones calling themselves go-getters either.

Laborers in poverty-stricken countries I’ve visited are in a perpetual state of exhaustion from being on their feet all day in scorching temperatures. Stark contrast to life in the US, where our standard of living is arguably the highest of any country in the history of the world.

Most of us are voluntarily busy so we can upgrade our luxury vehicles every two years. Some of us (if we’re being honest) are addicted to being busy to stave off the void that anxiety might fill.

Discipline Equals Freedom; Busy Equals More Busy

The self-congratulatory “I’m sooo busy” isn’t impressive—it’s lazy—mostly used to feel self-important. Or as an excuse to decline invitations. We need to bring back “good” as the default response when someone asks, “How are you?”

Our culture wears being busy as a badge of honor. But being busy and distracted makes you no different from the masses.

I implore you. Carve a different path. Learn to live deliberately through discipline and delayed gratification.

Schedule time to think & reflect. Plan & set goals. Hangout with friends & read books.

For those on the FIRE track—slowing down will help to combat the euphoria many of us feel upon getting a big raise or fat commission check. Feelings which might otherwise intoxicate us into unwise decisions.

FIRE goals are ambitious. Therefore you must resist the temptation to inflate your lifestyle. And most importantly, work hard to extend the gap between your income and BIG 3 Expenses:

- housing

- transportation

- food

Allow self-discipline to fuel your FIRE goal. Because once your habits are sound and expenses under control, returns on both will start to compound. You’ll learn to be productive without being a “busy bee.”

My privileged position outside the hive has given me unique perspective. I feel like Johnny Nash, seeing clearly now the rain is gone. This clarity enables me to coach others who aspire to join the FIRE ranks.

We approach their finances with intentionality. They’ll be saving & investing a large portion of their income. Because they’re willing to make small sacrifices others aren’t willing to make.

The hardest part of the FIRE journey is obtaining your first $100,000.

Why The First $100,000 is so Important

There’s a famous story among financial wizards of a twenty-something who approaches Charlie Munger to complain about his net worth not growing fast enough. Munger, known for his wit and wisdom, says to him:

The first $100,000 is a bitch, but you gotta do it. – Charlie Munger

In other words, do what is necessary to get your hands on $100,000. Live with roommates, drive a POS car, take a second job, use a flip phone, eat Hamburger Helper. And most crucially, find a way to help others get what they want.

Once you save $100,000, investment returns start to make a significant impact on your wealth-building.

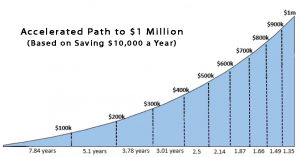

This graphic demonstrates how long it will take to accumulate $100,000 by investing $10,000 annually at a 7% annual rate of return.

Notice it will take 7.84 years to (mostly) save and invest your way to $100k. But if you keep saving $10,000 a year, it will only take an additional 5.1 years to get to $200k; then another 3.78 years to get to $300k.

Did you also notice it will take less time to go from $600,000 to $1 million, than it will take to go from $0 to $100,000?

Me, GTFOH? No, you GTFOH!

“Compound interest is the eighth wonder of the world.” – Albert Einstein

Don’t Wish it Were Easier, Wish You Were Better

If you don’t yet have $100,000, but you’re paying high car payments, drinking Lulu pants and wearing lattes, it’ll be tough to get there. And not because you keep spilling your coffee.

The FIRE journey is hard because there are setbacks and inevitable failures. For example, I had been hardcore investing for several years after college when the economy tanked. Every dollar I’d invested in the market was nearly cut in half; my first rental property lost 30% of its value.

But I kept my head down, worked two jobs, increased my retirement contributions, tracked spending, and took calculated risks. The journey to FIRE isn’t easy, but it is worth it.

Need proof? Lady O and I are in San Miguel De Allende, Mexico. We go for long walks on cobblestone streets, rarely use an alarm clock and work on projects of our own choosing. Our AirBnB (click here to get $40 off your first stay), which is a 5-minute walk from SMA’s historical center, cost less than $1,000/month. Since our hobbies aren’t expensive: reading/writing, working out and cooking meals at home, we still save & invest up to 62% of our income. While old habits die hard, we’ve also picked up new ones—we like to take naps in the afternoon.

Yeah. I used to be that guy who bragged about being crazy busy. Until a trip to the Dominican Republic changed that. I don’t work hard. They work hard!

Good rants. And very happy for your parents. Good to see that there is real love left in this world. Gives this hopeless romantic hope.

Ditto friend. Haven’t been to DR yet, but I can imagine. “Crazy busy” is a wealthy people problem. #wpp

Thanks, Roman. Indeed, love is a verb.